Welcome to the second issue of Volunteer Capital Insights! We hope you had an amazing Labor Day weekend, especially after the 69-3 win over the University of Chattanooga! Unfortunately, if you’re a Florida State fan or a Boeing stockholder, your week probably hasn’t gotten off to the best start—so we hope you find some enjoyment in this newsletter! In this week’s edition, we’re diving into the exciting world of the aerospace sector, private equity’s touchdown in the NFL, Nvidia’s impressive earnings, and the latest on the PCE.

A special shoutout to our friend Peter Costa from Costa’s Corner for helping us edit this week’s edition. Don’t forget to check out his Substack for more great content!

Let’s break it down!

Private Equity

Skin in the Game: Investing in Sports

This past week, the National Football League decided to open its doors to select institutional investors, cementing its status as the last of the “Big 4” leagues to welcome private equity into its ranks. Firms including Arctos, Ares, and Sixth Street Partners have already capitalized on the supply and demand imbalance of league ownership, highlighted by the surplus of potential buyers (billionaires) and the finite number of major league teams. With the NFL’s momentum showing no signs of slowing down, these firms – and likely many others – are positioned to claim up to a 10% stake in the largely unregulated monopoly.

Major League Baseball led the way in 2019 by changing its ownership rules, allowing private equity investors to hold passive, minority stakes in multiple teams. The NHL and NBA followed suit shortly after, recognizing that funding state-of-the-art stadiums and entertainment districts on their own was becoming increasingly out of reach. Now, with institutional investors jumping in, it seems everyone wants a piece of the action. Just this past weekend, the Buffalo Bills tapped Bills Mafia to help finance the team’s new $1.7 billion stadium through municipal bonds.

It makes sense, though. As the value of sports franchises continues to soar – fueled by billion-dollar media rights deals, sponsorships, and merchandising – these revenue streams are only set to grow. The question is, what’s next for private equity? Kids’ sports? Believe it or not, that’s already been done, but that’s a story for another time. In the meantime, check out the Big 4 sports team valuations benchmarked against the S&P 500 below. Maybe it’s time to invest in DA BEARS.

By: Will Gusanders

Equities

More Turbulence for Boeing

Tuesday, August 20th, Boeing stock dropped 5% following a test flight of the long awaited 777x test jet. During said flight, cracks in the structure of the jet were discovered, and eventually also found on two other jets. The particular part in question has been identified as the "thrust link," which connects the engine to the rest of the plane. Aside from the thrust link, many other issues were identified in the now four year delayed project, including a problem with the pilot's seat in the cockpit. While covid related delays are excusable, seeing as the entire market was hit, I find it hard to place any confidence in Boeing right now. With the infamous Alaska Airlines emergency exit door malfunction involving the Boeing 737 MAX 9 not so long ago, it is clear that the company has not made the necessary adjustments in quality control to warrant investor trust. Perhaps finding these problems now is indicative of quality control progress, but we still need sustained evidence of better quality control before placing any confidence in Boeing again.

Many investors question if Boeing's largest competitor, Airbus, is a worthwhile investment with the current issues Boeing faces. I would argue that despite Airbus having the advantage at the moment, it is not a worthwhile investment. There is nothing special about Airbus currently that makes me think they are capable of capturing Boeing's lost market space. It takes years to develop airplanes. It is one of, if not the most expensive, difficult, and regulated manufacturing processes on the planet. Both manufacturers have hit a metaphorical ceiling on how many planes they can produce due to the aforementioned difficulties. Both manufacturers have orders that they will not be able to fulfill for years. Thus, it is unlikely Airbus will see significantly more than a short term temporary bump in competitive orders vs Boeing in 2024 and 2025. Airbus has only a short term window to capitalize on the hole Boeing's misfortune leaves in the market. I think aerospace stocks with larger defense operations such as Lockheed Martin and Leidos are more promising, given rising geopolitical tensions in the middle east and eastern Europe.

Both Lockheed ($LMT) and Leidos ($LDOS) have seen extraordinary growth YTD, with Leidos nearing 50%, and Lockheed seeing around 25% increases. However, I am more bullish on Leidos due to increasing earnings estimates and price targets by analysts. Further, with the election coming ever closer, it is unclear if the US will continue to send military aid to Ukraine due to the differing positions of candidates Kamala Harris and Donald Trump on the controversial issue.

By: Nick Huber

Equities

Nvidia’s Electric Earnings

Nvidia just reported a massive $30 billion in revenue for the second quarter, which ended on July 28, 2024. This is up 15% from the last quarter and a whopping 122% compared to a year ago. Over the first half of fiscal year 2025, Nvidia also returned $15.4 billion to its shareholders through buybacks and dividends, with another $7.5 billion still available for more share repurchases.

Despite these impressive numbers, Nvidia’s stock took a 7% hit on September 3rd. The reason wasn’t the revenue itself, but rather concerns over slightly lower gross margin guidance for the rest of the year. According to Bernstein senior analyst, Stacy Rasgon, Nvidia is in a holding pattern until its next-gen chip, Blackwell, starts production in Q4. If Blackwell delivers as expected, the stock should follow in a big way.

But here’s where it gets interesting: a big chunk of Nvidia’s revenue comes from just a few key customers. In the first quarter of fiscal 2025, one customer alone made up 13% of their total revenue, and another made up 11%. UBS analyst Timothy Arcuri thinks the biggest of these customers is Microsoft, which he believes accounted for 19% of Nvidia’s revenue in fiscal year 2024. Microsoft has been ramping up its AI game, especially with its CoPilot product and its partnership with OpenAI, which likely explains why they’re such a big customer.

If you’re thinking about investing in Nvidia, it’s important to realize how much they rely on a few major players like Microsoft. While this can be a good thing, showing strong partnerships and high demand, it also means Nvidia’s fortunes are closely tied to these relationships. If anything were to change, like if Microsoft decided to scale back, it could have a big impact on Nvidia’s bottom line. Understanding this is key when considering Nvidia as a long-term investment.

By: Cayle Beltran

Economics

Inflation Eases, Prices Still High

Last Friday, the Bureau of Economic Analysis (BEA) released the Personal Consumption Expenditures (PCE) data for July, the Fed’s preferred inflation gauge. The report showed continued signs of cooling inflation, with the year-over-year rate holding steady at 2.5% and a monthly increase of 0.2%. The core portion of the index, which excludes food and energy, also rose by 0.2% for the month and remained steady at 2.6% for the year. Both the PCE and core figures were in line with market expectations. Additionally, the report highlighted a 0.3% increase in personal income, beating the estimated 0.2%.

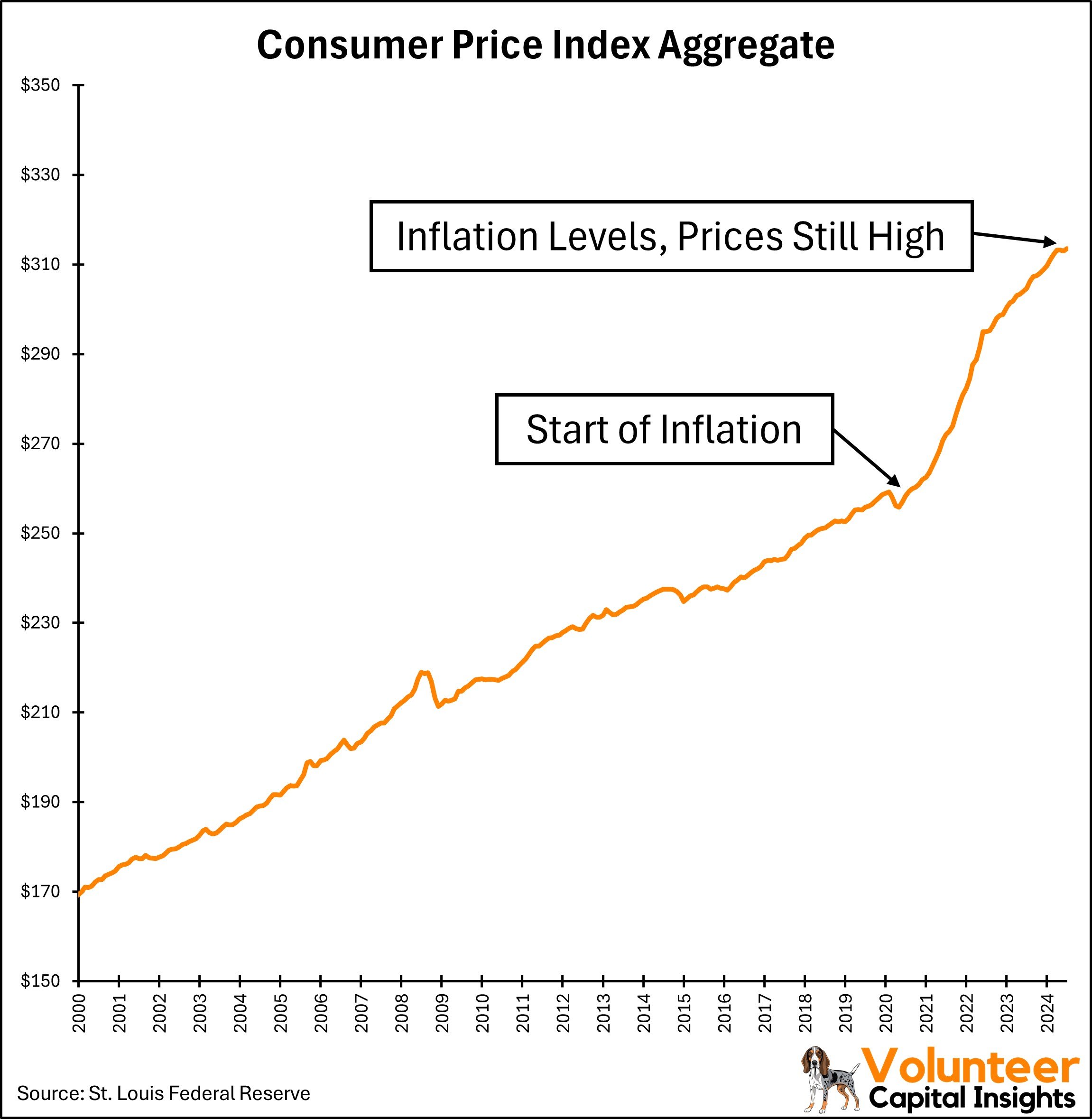

When considering inflation, it's important to focus on its definition "the rate at which prices increase over time" and its cause, which occurs "when demand for goods and services exceeds the economy's ability to produce them." From this perspective, inflation has eased, and prices are not rising as they were in 2021 and 2022. Demand for goods has dropped significantly, and supply has recovered. However, consumers still notice the substantial increase in price levels. A look at the CPI aggregate graph clearly shows that while the rate of inflation has slowed, the elevated price levels have not decreased. This highlights the difference between the percentage change in inflation and the actual prices consumers see while shopping. Ultimately, while the Fed has succeeded in slowing the economy and inflation, consumers remain frustrated by the persistently high price levels.

By: Andrew Brown

Thanks for tuning in, we appreciate your support!