Welcome back to another issue of Volunteer Capital Insights. Thank you for giving us your time to hear our perspectives on the world. Since the start of the year, interest rates have been trending in all directions, which will have significant impacts on many aspects of the economy. In this issue, we cover the effects on real estate markets, private markets, the $9.2 trillion in debt set to be refinanced, the bond market, and the equities market.

Let’s break it down.

Real Estate:

According to a Deutsche Bank survey, recession fears have risen to 43%, with J.P. Morgan also predicting a 40% chance of a recession in 2025. These fears have prompted more American investors to turn to Real Estate Investment Trusts (REITs) as a “safe haven” from a potential large-scale market selloff. REITs have historically shown much lower volatility across business cycles compared to traditional equities, offering high and consistent dividends as a source of income during periods of market volatility. This increases their attractiveness to income-focused investors who seek reliable cash flow regardless of market conditions. REITs are projected to return 9.5% in 2025, with significantly less downside risk compared to the S&P 500.

REIT performance may also get a boost as the Federal Reserve expects to continue lowering interest rates in 2025, leading to lower borrowing costs and higher real estate valuations. Several REIT sectors are showing strength due to high demand, including industrial, data center, and residential. Additionally, investors may prioritize REITs in recession-resistant sectors like healthcare, infrastructure, and multifamily residential housing.

That said, the outlook for REIT investments remains mixed. Although interest rates are gradually declining, they remain elevated enough to pressure REIT valuations. Even small fluctuations in rates can shift both investor sentiment and the underlying economics of property ownership and valuations.

As of this month, home price growth has plateaued, and annual gains remain only slightly above inflation. In February, existing home sales rose 4.2% month-over-month but declined 1.2% compared to the same month in 2024. Analysts project a stagnant housing market for the remainder of the year, with a modest 3% increase driven by falling interest rates. In January, the median home-sale price reached $396,900, a 4.8% increase from 2024.

While REITs present a compelling option for income-focused investors amid rising recession fears and falling interest rates, their performance remains sensitive to rate fluctuations and broader market uncertainty. Despite mixed signals in the housing market, select REIT sectors may still offer strong returns and stability in a volatile 2025 landscape.

By: Dean Zike

Navigating Market Uncertainty: The Role of Private Capital Markets

Market uncertainty remains high heading into mid-2025 – interest rate ambiguity, growing geopolitical tensions with Russia and China, tariff threats, and slowing economic indicators have been dominating headlines. One thing has made itself clear: the public markets hate uncertainty. As of March 31, the S&P 500 is 8.66% below its record close on February 19, and is down 4.37% year to date.

Figure 1. S&P 500, past 6 months, as of 4/2/2025. Source: Bloomberg

Despite all the noise, the private markets – especially private equity and private credit – have a track record of outperforming public equities in times of economic distress. Across multiple crises, including the 2008 Financial Crisis and the COVID-19 crash, private markets have shown resilience, largely attributed to several key advantages:

Long-Term Holding Periods: PE firms typically hold assets for 5-10 years, giving them the flexibility to weather downturns without being forced to sell into weakness. This structural insulation allows them to take a longer view, even during short-term market shocks.

Active Management: Unlike passive investors in public companies, PE sponsors can often step in and directly improve operations, shift strategy, or restructure their companies, giving them the opportunity to add value even when public markets are uncertain.

Valuation Insulation: Private assets are not traded daily, reducing the visibility of volatility and preventing panic-driven pricing reactions that are common in the public markets.

Figure 2. Global PE Index against MSCI ACWI Gross Index during major economic crises.

The private markets have shown consistent growth for the past 30 years. In 2023, global private markets AUM reached $24.4T, representing an 8.7% CAGR since 2021. This is driven by several factors, including investors’ search for higher yields, increasing number of HNWIs with more investable capital, and the largest intergenerational transfer of wealth in history. As the private markets have become larger and more liquid, many successful companies (like SpaceX and OpenAI) are choosing to stay private for longer than usual. This option has become appealing partly due to the reassurance of higher regulation standards in private company governance models and less reporting red tape compared to public companies.

Figure 3. Private capital market growth over the past decade.

Figure 3. Private capital market growth over the past decade.

In a market where the only certainty is uncertainty, private capital continues to prove its relevance, no longer as simply an “alternative asset” but as a core allocation for long-term portfolios. As volatility puts the public markets on the defensive, expect the relative strength of the private markets to continue drawing capital in 2025 and beyond.

By: Zachary Marano

Impacts of Refinancing $9.2T of National Debt:

As of March 2025, the U.S. national debt sits at $36.2T, with $9.2T set to mature by the end of the year, representing over a quarter of the total debt. Since the beginning of President Biden’s term, the debt increased by $6.2T, driven by substantial deficit spending – much of it tied to pandemic recovery, infrastructure bills, and expanding social programs.

During that time, Treasury Secretary Janet Yellen issued much of the debt on the shorter end of the yield curve, anticipating that interest rates would remain low or fall. This strategy, while increasing flexibility, exposed the government to refinancing risk if rates were to move higher, which is exactly what happened.

Now under President Trump’s second term, Treasury Secretary Scott Bessent is in the position of refinancing a large chunk of maturing debt at significantly higher interest rates than when it was originally issued. For example, much of the 2020-2021 debt was at sub-1% interest rates. Today, comparable yields on Treasury bills and short-dated notes are hovering around 4.5-5.25%, depending on duration and market volatility.

Figure 4. Bloomberg Debt Distribution <DDIS> of the United States

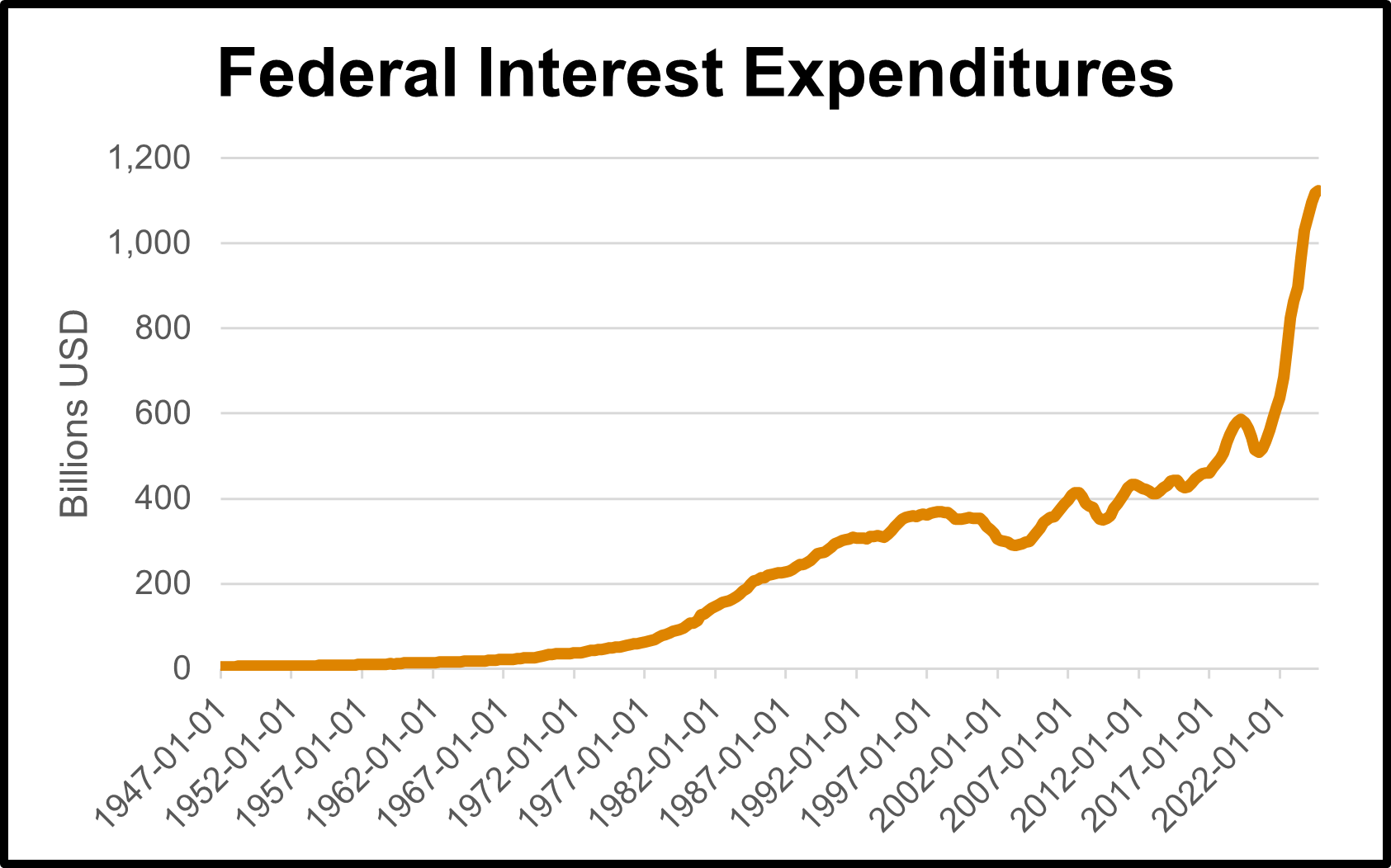

This shift has enormous implications for the federal budget. As debt rolls over into higher interest rates, the government’s annual interest tab has ballooned. Net interest on the debt now consumes over 12.9% of total federal spending, up from around 8% in 2019. At $881B in FY 2024, net interest has surpassed defense spending and makes up a whopping 3.1% of GDP.

Figure 5. Federal Government Interest Expenditures. Source: FRED

To reduce deficit strain, some call for cuts to both discretionary and mandatory spending. However, this is often viewed as a political impossibility and is practically difficult to achieve. Discretionary spending – everything from defense to education – is a shrinking portion of the budget, especially given the recent cuts implemented by DOGE. Nondiscretionary spending – programs like Social Security, Medicare, and Medicaid – make up the majority and are politically untouchable for both parties. The economy itself is also on what many economists call a “sugar high,” propped up by prior rounds of stimulus and cheap money that are no longer available in this higher-rate environment.

This trend is clearly unsustainable, as rising interest costs threaten to crowd out other critical areas of the federal budget. Without serious, politically difficult conversations about reforming nondiscretionary spending, the U.S. risks locking itself into a fiscal path defined by mounting debt and diminished flexibility.

By: Caleb Asbaty

Bond Market and the Federal Reserve:

The Federal Reserve has found itself in a predicament. Recessionary pressures are mounting as consumer confidence plunges and fears of tariffs weigh on both business sentiment and corporate earnings. At the same time, inflationary pressures are also on the rise, as tariffs are inherently inflationary. This puts the Fed in a tight spot, forcing it to continue balancing its dual mandate: supporting employment and controlling inflation. Recently, the Fed has prioritized employment over inflation; for example, in 2022, rates remained low for longer than expected, fueling inflation. Last year, the initial rate cut in September triggered a four-month rally, further driving inflation upward.

Figure 6. 10-year U.S. Treasury yield. Source: Bloomberg

While the Fed does not directly set interest rates for the bond market, the signal from the Fed is especially important, particularly if the need to hike rates were to arise. Right now, the biggest drivers of the bond market and interest rates are tough to pin down. Last week, it appeared that Treasury investors were weighing recessionary fears as yields moved lower. However, this week has brought a shift, with yields rising. This signals that investors are growing more concerned about the inflationary pressures caused by the recently announced tariffs. The biggest determinant of where the bond market goes moving forward will likely be the strength of recessionary fears. One thing that could be difficult for both the bond market and equities is if, like in 2022, bonds and equities do not hold their usual inverse relationship. That would mean equities underperform and bonds underperform as well, whereas historically, when equities struggle, bonds tend to outperform. If that were to happen, investors' flight to safety could look more like a crash to safety, with returns lagging on both sides of the portfolio. This could play out if the more hawkish bond investors drive rates higher out of fear of future inflation. On the other hand, the more dovish bond investors could win out if recessionary fears take the upper hand.

By: Brady Barlow

The Equity Market and the Federal Reserve:

Historically, equity markets and interest rates have had an inverse relationship. As interest rates rise, borrowing becomes more expensive for both consumers and businesses, reducing discretionary spending. This typically dampens revenue growth across most sectors, though financial institutions – particularly lenders – may benefit from higher interest margins. That said, the immediate market reaction to rate changes isn’t always negative. Markets have sometimes declined after rate decisions but then trended upward over the following months.

Back in September 2024, the Fed cut interest rates by 50 basis points – from 5.375% to 4.875% - in response to a weakening labor market and declining inflation expectations nearing the 2% target. The equity market responded positively, with the S&P 500 closing up 1.5% the next trading day, reflecting the typical inverse relationship between interest rates and stock performance.

At its March 19th meeting, the Fed held the federal funds rate steady at 4.25%-4.50%, following a total of 100 basis points in cuts the previous year. The Fed also projected two additional rate cuts in 2025. Citing uncertainty around President Trump’s tariff policies and steady consumer spending, the Fed opted to pause further rate changes. This was significant news, as the federal funds rate influences the rate at which banks lend to each other and serves as a benchmark for interest rates across the economy. Despite no rate change, the markets reacted positively, maintaining their upward momentum over subsequent trading days. On the day of the announcement, the S&P 500 rose 1.1% and the Dow jumped 4.0%.

Looking ahead, market expectations suggest an 88% probability of rates remaining unchanged at the May 7th meeting and a 61% chance of a 25-basis point cut at the June 18 meeting. However, the recent tariff announcements which sent a shock through global markets could alter the Fed’s decision making as the probability of a recession creeps ever higher. Amidst the market uncertainty, Fed chair Jerome Powell has signaled that the central bank is not inclined to intervene in equity markets adopting a cautious stance due to the unpredictable economic impacts of the new trade policies. For now, investors can only speculate until further guidance emerges about the Fed’s upcoming decisions.

By: Gavin Seaver